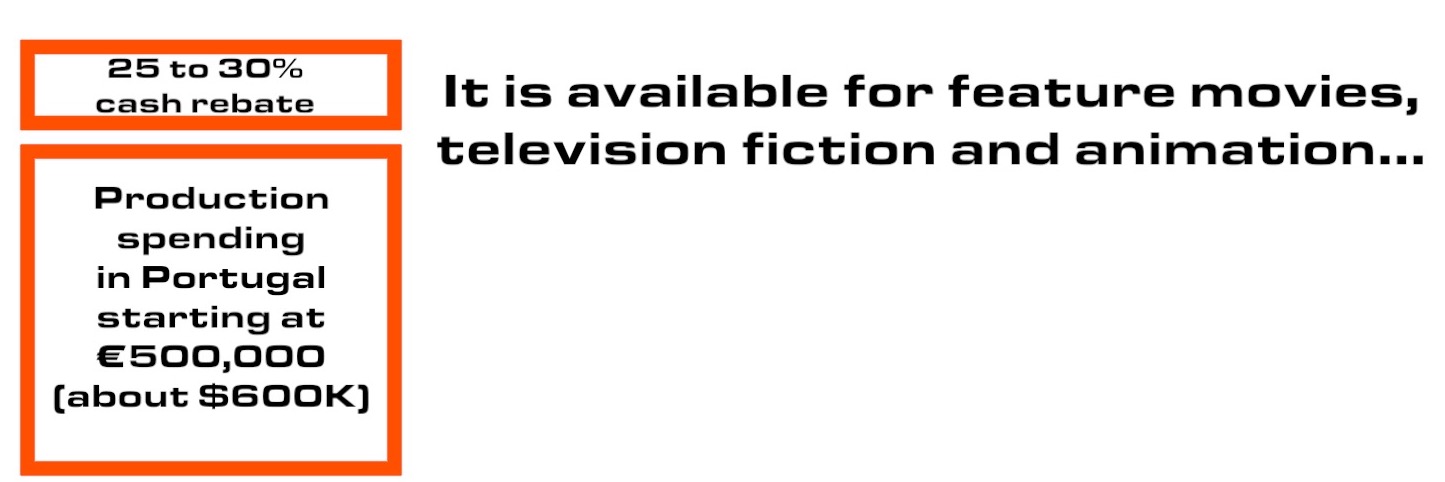

Luckymatrix reports on the new cash rebate incentive for film, television, digital production. Updated 25/07/23 The Instituto do Cinema e Audiovisual (ICA) is a Portuguese government agency whose mission is to promote and support the development of the country’s film and audiovisual industry. ICA manages film and television industry subsidies and PICPORTUGAL, the new cash rebate scheme underwritten by the national tourism board, Turismo de Portugal, and the ICA. It is available for feature movies, television fiction and animation projects spending in Portugal a minimum amount of €500,000.00(about $600K) The cash rebates is capped at €4 M (about $5M) per project.

***Next Call for the portuguese cash rebate is November 2023***

25 to 30% of your production costs reimbursed up front: this is the brand new portugese cash rebate, the most promising Film and TV incentive in Europe. The decree-law No.45/2018 has been published, followed by a further decree regulating the scouting incentive covering foreign productions travel costs and other services associated with "scouting" and feasibility study. In brief:

Between 30 and 50 million Euros have been allocated by the decree-law n°45/2018 coming into force in 2018.

The objective of the fund is to promote both Portugal as an all-year round tourist destination and one of the the best place in Europe to make international film and television projects.

The gateway to the cash incentive is a co-production with a portuguese company registered with the ICA. Projects are submitted to ICA by the portuguese company.

The cash rebate is a 25 to 30% reimbursement of portuguese production expenditures, including portuguese development costs and post-production costs.

This rebate is paid up front, in installments.

The percentage of the rebate is determined through a cultural test and review of the characteristics of the project and its economic impact.

And

to documentaries and post-production work starting at €250,000.00(about $300k).

Projects submitted for appreciation will be notified of a final binding decision of approval within 30 days, upon which, cash rebate instalments will be made available.

Eligible costs: all production-related expenses are a priori eligible. From crew and studio hire to hotels, accounting, etc.

In the case of the feature movies, eligible expenditures should fall within the following budget lines:

Above-the-line: copyright and royalties; producer fees; director fees; main actors.

Bellow-the-line: technical team; artistic team; social charges; travel, stays and transportation; scenography; technical means; image and sound supports; image laboratory; film editing; miscellaneous production expenditure; insurance and miscellaneous; production overhead.

Crew and companies should be subject to tax liability in Portugal to qualify as eligible costs. Companies that provide the service must be Portuguese and registered with the portuguese tax office. Crew should have Portuguese tax residence and fiscal ID number.

Foreign cast and crew could choose to be paid and taxed in Portugal, if their country of tax residence has a Double Taxation Agreement (DTA) with Portugal: a flat rate income tax of 25% applies for non-residents. These salaries will be considered eligible for the cash rebate.